Industry

I Will Persist Until I Succeed

“By perseverance the snail reached the ark.” ~ Charles Spurgeon ~ As a writer, I know if I don’t persevere I will never succeed. Rejections can destroy even the best of writers. Yet perseverance didn’t come naturally to me like the snail gunning for Noah’s ark. He knew if he didn’t keep going, he would…

Re-creating missing receipts

Have you ever lost an important tax receipt? I accidentally deleted a folder in my inbox one day. You know the one… the one where I file all of my receipts from Amazon. Not a great move, considering I need all of those receipts for my taxes. Or how about the day when my lovely…

Hobby Loss interpretation for writers

A lot of writers wonder if their writing business will be considered a hobby by the IRS. The IRS has specific guidelines for determining whether or not a business is for profit, but some of the rules can appear confusing, especially as they relate to writers. While the following list can’t replace sitting down with…

Do I need to file taxes as a writer?

Tuesday are Tax Tips Tuesday here for the next month. Need more relavent information on writing and taxes? Click on the tag Tax Tips Tuesday or click HERE! Do I need to file taxes as a writer? The simple answer is it depends. Here are a few considerations in deciding whether or not…

Tax Tip Tuesday: Common Direct Expenses for Writers

Writers work in all different genres and write for a variety of media outlets. Some of us are business writers, others create romance novels and many write articles for magazines or copy for web sites. Putting words into print is our profession, but dealing with the financial aspects of our writing business can be challenging.…

Tax Tip Tuesdays: Automobile Expenses and Deductions for Writers

With taxes about a month away, many writers are confused as to what expenses are tax deductible. When it comes to your automobile, here are some guidelines. Automobile Expenses for Writers Driving to the local office store to purchase writing supplies can generate a tax deduction with proper documentation. This is what you need to…

Marketing: 10, 100, and 1000 Dollar Work

So you’ve got a book coming out and the marketing director at your publisher calls you up, very excited about your book. You’re excited too, until she tells you all the things she wants you to do to promote your book. Put up a web site. Create a blog. Make a Facebook fan page and…

Tax Tips Tuesdays: Business Meals for Writers

Business Meals for Writers Writers may choose to meet with their agents over lunch or they might arrange to meet a subject to interview at a local bagel shop. The cost of the meal can be a tax deduction with proper purpose and documentation. 1. The primary purpose of your business meal must be related…

Using Your Bachelor of Arts Degree to Launch Online Writing Careers

When you earned your bachelor of arts degree, you may not have been quite sure of what you were going to do with it. The intent of the degree is that it will allow students to explore a range of subjects, some of which may be familiar, and others that may be entirely unknown. In…

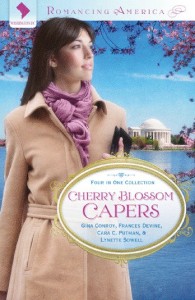

From Contract to Shelf: My Book’s Story in Statuses and Pictures

I thought I’d take the time to reflect on the one year gestation period of my “baby.” Special thanks to Facebook and my overactive status updates! Couldn’t have posted this without you! December 2010: My anthology partners contact me to see if I want to resubmit our novella to Barbour now that Barbour was open…